Utilizziamo i cookie per rendere migliore la tua esperienza di navigazione. Per rispettare la nuova direttiva sulla privacy, è necessario chiedere il tuo consenso per impostare i cookie. Per saperne di più.

Top day trading strategies

In this article we will elaborate the principles and general day trading rules, as well as explain some of the most popular day trading strategies. The definition of day trading by Investopedia is: “The act of buying and selling a financial instrument within the same day, or even multiple times over the course of a day, taking advantage of small price moves”.

There are two types of day trading strategies, pure day trading and swing trading. Pure day trading is all about profiting by predicting small price changes, and ending the trading day in cash with no open positions overnight. Swing trading includes holding a position open overnight or for a several days up to one trading week. Most day trading strategies are a combination of these two types, depending on the financial instrument.

Day trading strategies are based mostly on using charts and technical indicators data to determine the patterns, volumes and the price movements of a certain instrument. Common technical indicators that are used in day trading are resistance and support levels, MACD, moving averages, volatility, Bollinger Bands, RSI and candlestick patterns.

These are the most widely used day trading strategies:

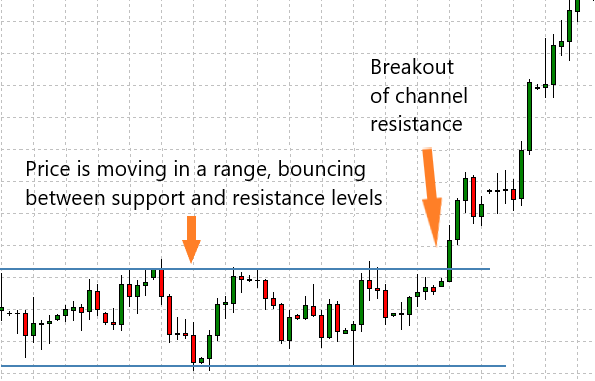

Breakout strategies

The breakout strategy is one of the most frequently used day trading strategies, both by beginners and professional traders. The idea is to enter a trade when the price clears an important level on the chart. That level could be support, resistance or a psychological price level. If a support level is broken, the price is expected to move downwards until it reaches a new support level, and vice versa, if a resistance level is broken the price tends to move upwards until it reaches a new obstacle. Usually, when the price breaks a critical level, there is an increased volume that causes volatility, which tends to push the price away from the breakout level. The increased volume serves as an additional validation that the new price levels are sustainable. And, conversely, if the price movement is not supported by high volume, there is a possibility of a reversal, this is called a false breakout.

Scalping strategies

Scalping strategies are some of the most popular day trading strategies, mainly applied in trading liquid and volatile instruments. This type of day trading strategies are based on executing numerous trades in a short time period and closing them as soon as they reach 2-3 pips of profit. These are very fast paced strategies and very often the trades are closed within a few seconds after their opening. The idea here is to accumulate a lot of small wins that add up to a good profit at the end of the day.

Momentum strategies

Momentum trading refers to multiple day trading strategies. It is usually based on trading the news or trading strong trend moves. In both cases the moves are accompanied by high volatility and volume. The effect that a news report has on a security can be seen within a few seconds after it has been published. As the volatility increases, the price is quickly pushed in a given direction, depending on the content of the news. Day traders use this strategy because of its ability to earn a considerable profit in a short period of time. The core of these day trading strategies is that the price movement will pick up enough momentum to allow it to continue trending in the same direction for some period. Like in other day trading strategies, precisely timed entries and exits can make an enormous difference in your daily profits.

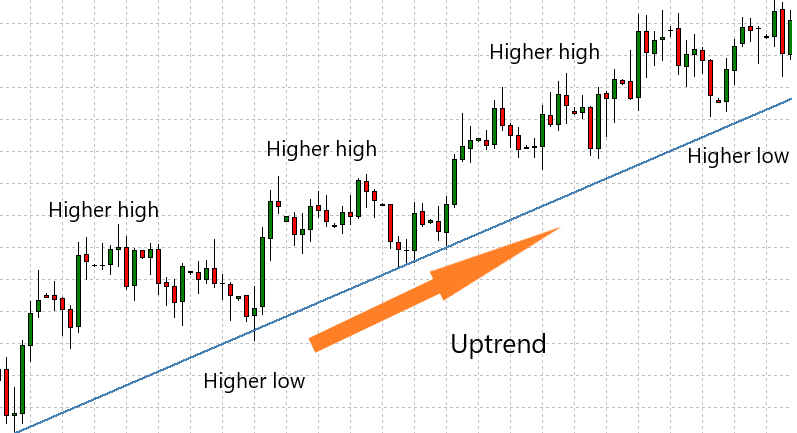

Trend trading strategies

The trend is the general direction of a market or of the price of a financial instrument. Trend trading is known as a continuation trade setup, which means that the rule in these day trading strategies is to buy in uptrend and sell in downtrend. As the name implies, this strategy is based on following the trend. The market is in uptrend when the price movement creates higher highs and higher lows which can be connected with an upward trendline, and vice versa, in downtrend the price creates lower highs and lower lows. To determine the direction and strength of the trend, and as well to anticipate the next price movement, many different techniques can be used, including indicators like the average directional index (ADX) and moving averages, price action, trendlines and channels.

Mean reversion strategies

Also known as pullback or reversal trading strategy. This strategy aims to trade against the trend. It is used in markets with strongly established trends. An entry opportunity occurs after the price drifts away from the trend. For example, if in a downward trend, there is an upward price movement above the long-run average, a pullback down could be expected. According to the mean reversion theory, the price fluctuates randomly around its trend and if it deviates further away, it will eventually reverse direction and return back to its normal trend.

Conclusion

Day trading strategies can be very profitable if used correctly, since they provide numerous trade opportunities within a single day. The entry and exit points and the timing are crucial in day trading, as the trades are closed within the same day, sometimes even seconds after they were opened. Day trading offers an opportunity for profiting on relatively small price movements in liquid instruments that trade at high volumes with enough volatility to allow the price to have a significant movement throughout the day.

Want to create your own trading strategy? Ask us to code a custom Expert Advisor or visit our store.