Utilizziamo i cookie per rendere migliore la tua esperienza di navigazione. Per rispettare la nuova direttiva sulla privacy, è necessario chiedere il tuo consenso per impostare i cookie. Per saperne di più.

Reading a Backtest Report

Backtesting - How to read a backtest Report

Testing a trading system or Expert Advisor (EA) could be time consuming, but thanks to the Strategy Tester tool on MetaTrader, you can test a trading system using historical price data from several years ago without having to test it real time. It is called “backtesting”, which can make testing a trading system much faster.

It is recommended to perform a backtest before a forward test for time efficiency reason. Of course, you will need a forward testing in real time market afterward, but a backtest will provide preliminary information about the trading system you are about to use or test. However, in order to get a good quality of backtest result, you have to use adequate historical price data.

After testing a trading strategy using backtest method, you will have to analyze the result so that you will know whether the trading system or the EA is as good as your expectation. There are many parameters you should look at and you need to understand what those numbers are telling you.

You don’t have to understand every number from the report. All you need to look at is just some key parameters that can be used to evaluate whether a strategy is a winning or losing one.

Here are some key parameters and what they tell you about the trading system.

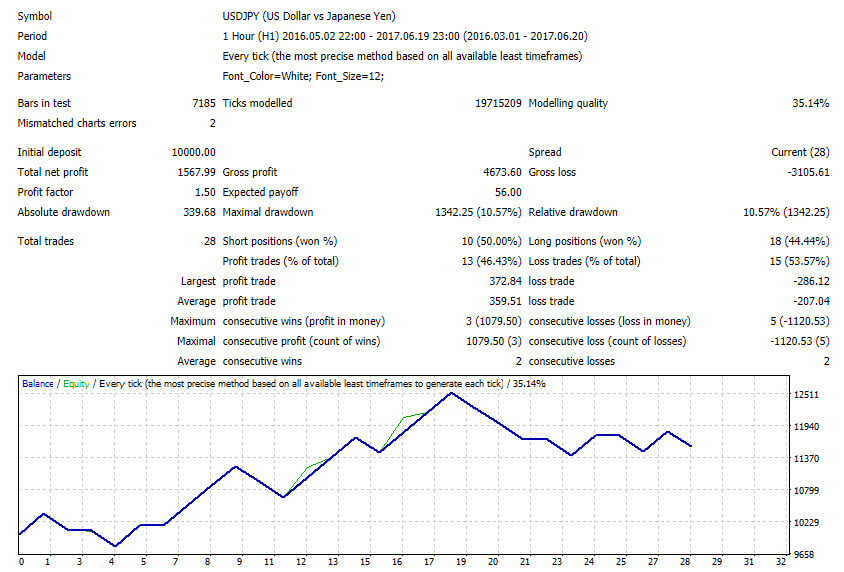

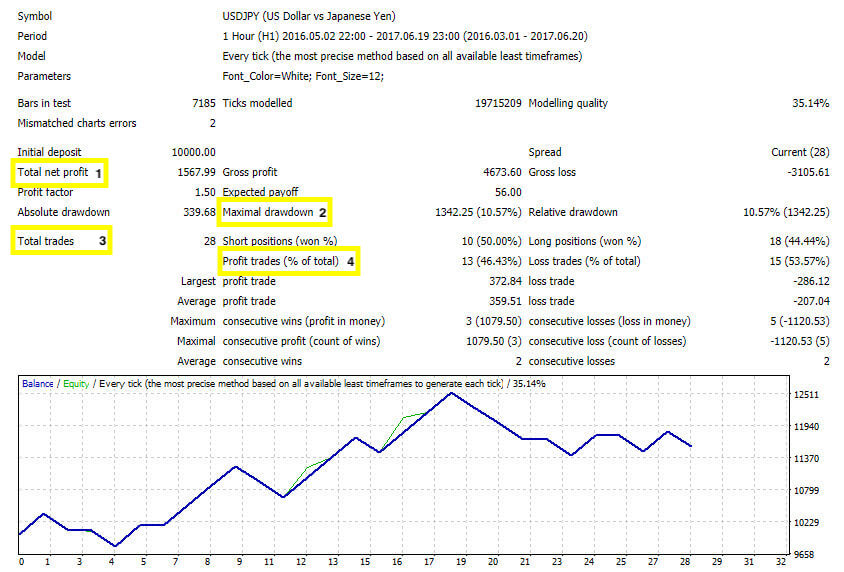

1 - Total net profit

This is the financial result of all trades that is generated by your trading system if you had used them in the past. A winning strategy should provide profits instead of losses. This parameter shows you what could happen if you use this strategy properly. Remember, this is not a guarantee that the system will work exactly like this in the future, but at least it can show you how much you possibly will get using this system.

2 - Maximal drawdown

Maximal drawdown is the largest loss of the local maximum in the deposit currency and in per cents of the deposit. You don’t want this number is too big. However, it would depend on how much money do you have in your trading account and how big is your risk tolerance. For example, if you have $10,000 in you trading account and your risk tolerance is just 20% of your money, then your trading system’s maximal drawdown should not more than $2,000. To make it simple, the lower the number is, the better.

3 - Total trades

This is total amount of trade positions. You can analyze whether your trading system is aggressive or moderate by comparing this number to the timeframe for the investing horizon. For example, if total trades are 200 in three months, it means the trading system makes 3 trades daily in average (assume 1 month has 20 business days). It means this strategy is not too aggressive and probably suitable for intraday trading strategy. If the number is smaller, then it probably would be suitable for mid-term trading.

4 - Profit trades

This parameter tells you the amount of profitable trade positions and their part in the total trades, in per cents. Simply put, this parameter tells the trading system’s win ratio. The bigger, the better.

As mentioned above, you should perform a forward test afterward. A forward test is a test in real time market. It is necessary in order to validate all of the evidences you’ve got from the backtest. Forward testing also important to get legit proof that you have avoided overfitting during the backtest process.

In this article we decided to show some of the simplest parameters for a backtest, in order to give some inputs on how to start reading a backtest. It is important to understand all the parameters shown in a backtest report, in order to be able to correctly evaluate the backtest and the potential performances of our Trading System