Utilizziamo i cookie per rendere migliore la tua esperienza di navigazione. Per rispettare la nuova direttiva sulla privacy, è necessario chiedere il tuo consenso per impostare i cookie. Per saperne di più.

MT4 vs MT5 - A comparison

MT4 vs MT5 – What are the main differences?

As the trading industry advances newer platforms offer more features and older time-tested platforms still hold the industry standard, the question arises: MT4 vs MT5 – how to choose which one is better for you? Metatrader 4 and Metatrader 5 are the two most commonly used platforms amongst retail traders and almost all brokers offer both of them. To clarify, MT5 was not intended to be an upgrade of MT4, although they both serve the same function and look fairly similar.

Something that could explain some of the differences of MT4 vs MT5 is the fact that MT4 was specifically designed for forex traders, while MT5 was aimed at a different market, so it also provides access to trading stocks and futures.

Both platforms are produced by the same company, Metaquotes, while MT5 was released in 2010 in a time when MT4 already existed for five years and was very popular, and because of it MT5 remained mainly unnoticed at least until it was sufficiently updated.

A quick comparison of MT4 vs MT5

The obvious thing when you open the platform is that it offers 21 different timeframes, of which 11 are minute charts and 7 are hourly charts, whereas MT4 has only 9 time frames. This is an impovement as it allows traders to analyze the markets on many different levels. Clearly this is a win for MT5 in the contest of MT4 vs MT5. The big advantage of MT5 over MT4 is that all the timeframes are generated starting from the 1 minute timeframe.

Other improvements that were implemented in MT5 are that it offers:

- 6 types of pending orders

- 38 built-in technical indicators

- 44 graphical objects.

Compared to it, MT4 offers:

- 4 types of pending orders

- 30 built-in technical indicators

- 31 graphical objects.

MT5 allows fund transfer between accounts, has embedded MQL5 community chat and has a built-in Economic calendar that delivers macro-economic news that may have impact on the market prices. Both platforms support hedging, while MT5 also provides netting accounts where all orders for the same symbol are managed in one position.

The platforms are not compatible with each other, namely the same trading account cannot be used on both of them, as well as the expert advisors, indicators and scripts are not compatible with both platforms. The programming languages are completely different, as developers aimed to add more options and to overcome some of the limitations of the older platform. This is the result of the fact that they wanted to create a new different platform that’s not just an updated version of MT4.

Next we’ll see some of the new features that MT5 offers.

Strategy tester in MT4 vs MT5

Unlike the older platform which has single threaded strategy tester, the MT5 strategy tester is multi-threaded, meaning that you can run a backtest of a trading strategy on multiple financial instruments at the same time. The program is run through the MQL Cloud Network, which is comprised of tens of thousands interconnected computers working together to deliver efficient and fast calculations.

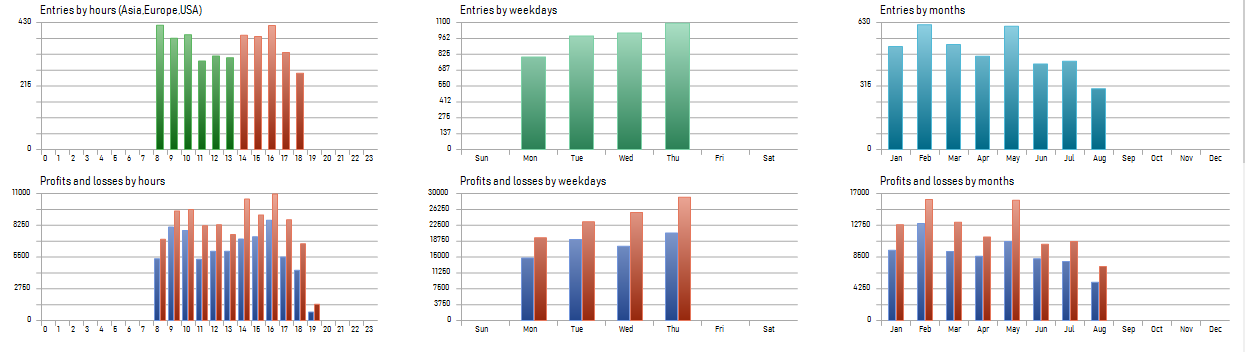

The results of the backtests other than the usual report contain neat charts and graphs that display additional information. The report can be saved as HTML file that opens through the browser or as Excel file, where MT4 supports only HMTL files. When comparing the strategy tester of MT4 vs MT5, clearly MT5 has more advantages.

No matter which platform you use, it is essential to use reliable and high quality historical data in order to get the most precise testing results and to better optimize your strategy for live trading. Let's now see what is a custom symbol.

Creating custom symbols

This function introduced in the MT5 platform creates new opportunities for analyzing any financial market, as well as for developing and testing trading systems. Creating a custom symbol means that a new custom chart will be generated according to your specifications, which can be used for technical analysis and also in the strategy tester for testing expert advisors and indicators.

Here are some instructions for creating a custom symbol: Open the Symbol list from the standard toolbar at the top, or press Ctrl+U. Select a symbol which you want to use and press the button “Create Custom Symbol” at the bottom of the window. A new window will open in which the symbol parameters are shown and can be configured. You can modify the contract size, minimal and maximal volume, operation days and time, symbol currency, allow only market or pending orders and many more parameters that will affect the test results of an expert advisor running on the custom symbol.

From here you can also create synthetic instruments by inserting a formula for calculation. For example, you can create the US dollar index by inserting its formula in the “Synthetic instrument formula” field, or create your own custom indices by applying a formula and using data for any symbol.

Naturally, it is very important to use data from a reliable source when creatin a custom symbol. We recommend using only high quality historical data for strategy testing, since it can make a huge difference in the test results.

Conclusion

That was our short comparison of MT4 vs MT5. The final choice of which platform to use is up to you. The simplicity of MT4 makes it more suitable for beginners. It is relatively easy to use and has been tested and improved with time since it was released in 2005. MT5 is considered to be more professional platform for trading more markets as stocks or futures. It offers more functionalities as we mentioned, like cloud testing of strategies and portfolios, more time frames and economic calendar. The industry is evolving towards the newer platform, but it can still be said that MT4 holds the industry standard for now.