We use cookies to make your experience better. To comply with the new e-Privacy directive, we need to ask for your consent to set the cookies. Learn more.

High Potential Days Strategy

The markets seasonalities

I was reading a book of Larry Williams called “Long Term Secrets to Short Term Trading” and my attention was caught from these 2 senteces:

“…a certain day should not be more predisposed than another day to upward or downward trend. The market however tells us the opposite: there are in advance better days to buy and better days to sell.”

“…the use of a simple filter, the TDW (Trading Day of Week) or the TDOM (Trading Day of Month), allows us to do what scholars say that is impossible: beat the market.”

I thought the market went up or down for hundreds of reasons, but not for what he was saying. I didn't think markets could have a clear annual, monthly or weekly seasonal trend, especially in long periods of time.

Then Larry began to show in the book some interesting statistics about his trading systems using this kind of strategy on S&P, corn, gold and other markets.

However I didn’t believe so much to his positive results, so I decided as usual to do my researches.

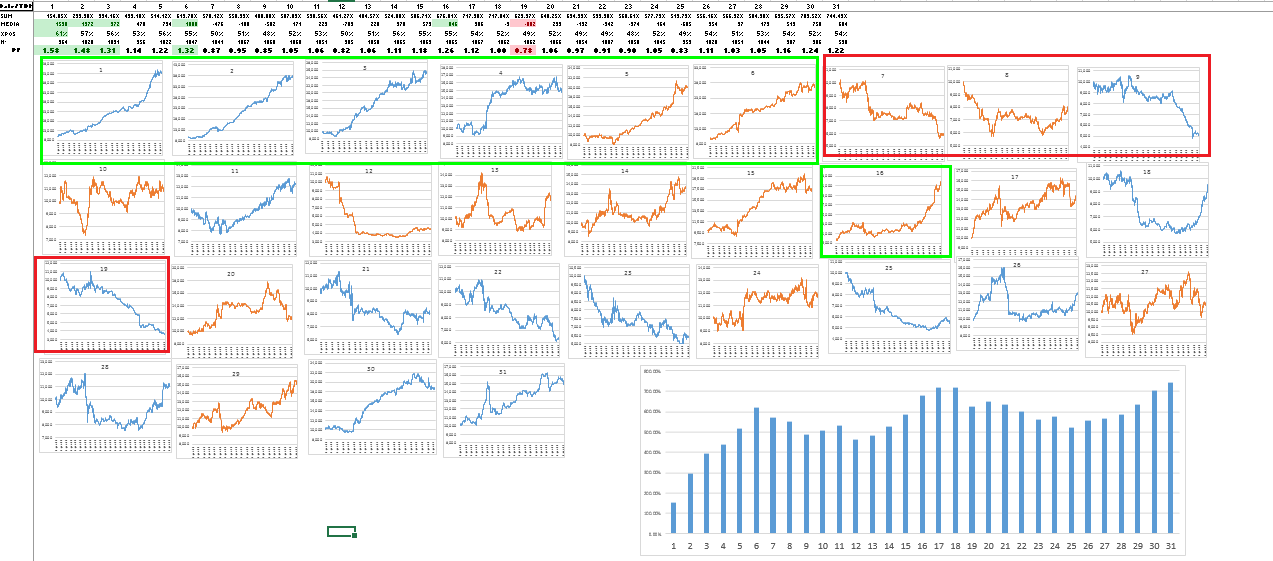

Dow Jones: Days of Month equity lines

I've taken the Dow Jones data since 1900 and I created a system to analyze the single days of the month, from the 1st to the 31th.

The charts below show the equity lines given by 1 day trading in Dow Jones, it means that I buy Dow Jones at the beginning of the day and sell it at the end of the day:

I expected that every day on average was neutral, because I was analyzing over 100 years of data and over 1200 cases each day.

Instead I was suddenly surprised and I got directions that Larry did not even say in the book.

As you can see Dow Jones market is historically bullish the first 6 days of each month, and lateral-bearish on the 7th, 8th and 9th days. And there are other interesting days, such as the bullish 16th and 18th or the bearish 19th.

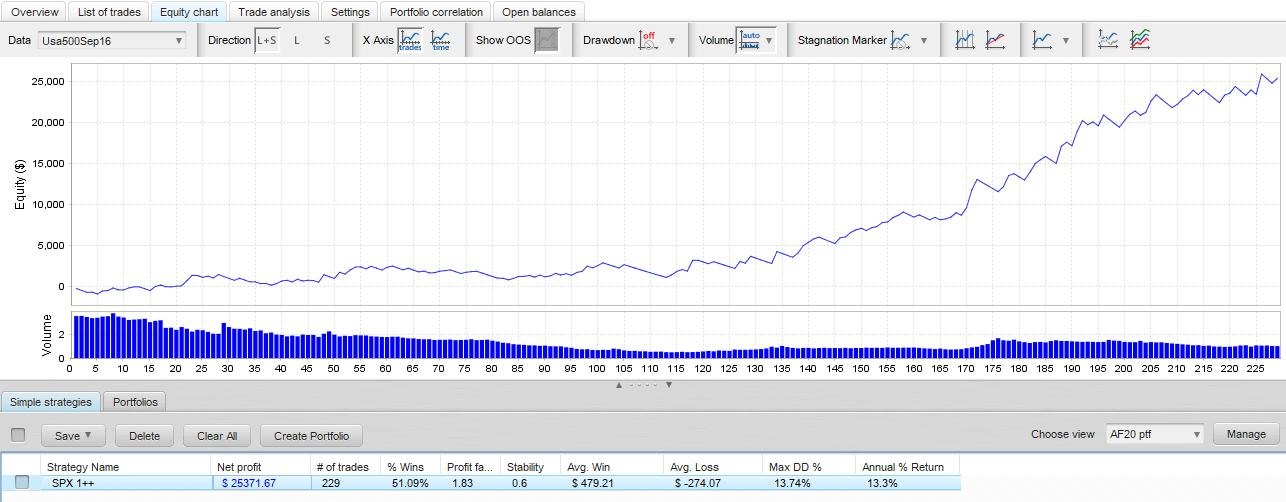

BTM High Potential Days Trading Systems

So the first High Potential Days expert advisor I created was on S&P 500 that goes long on S&P the 1st day of the month:

Honestly, I don’t know why the recurring movements happen and what are the dynamics...

Then I have continued my analysis in Excel and MT4 through all others most traded symbols with historical data up to 1970. I discovered other 30 evidences like the one I showed you on S&P 500 with which I created the HPD Portfolio.

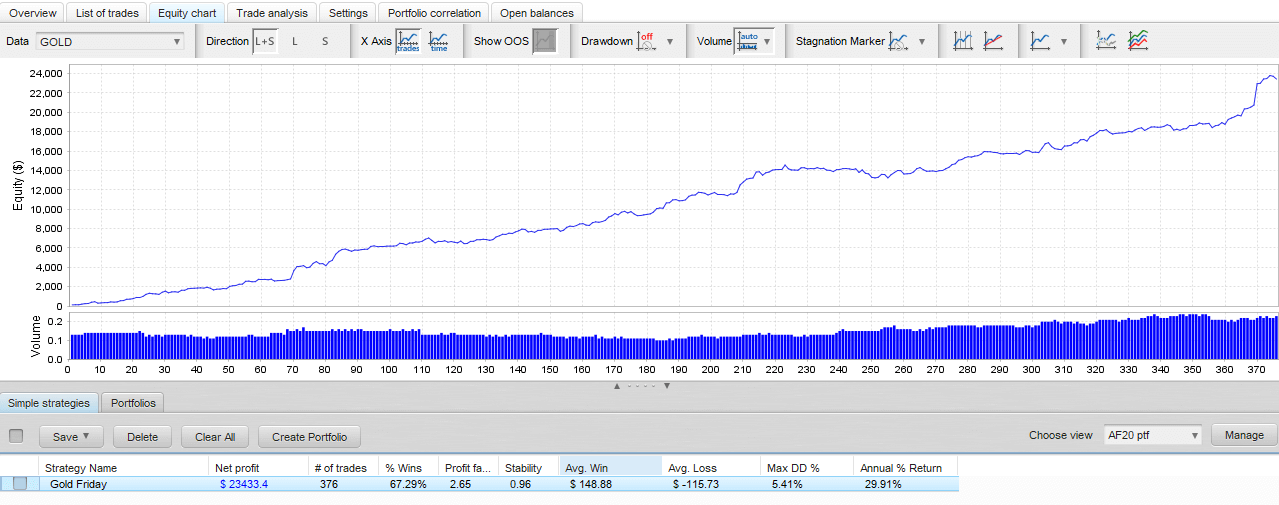

GOLD: on Friday the price of gold tends to rise:

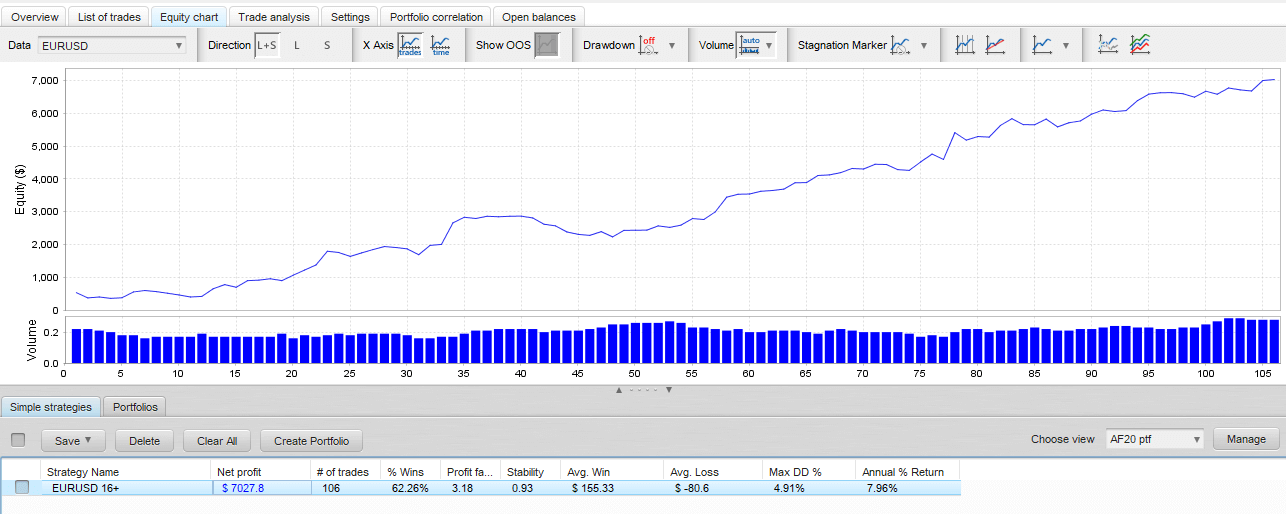

EURUSD: on the sixteenth day of the month, the Euro tends to gain versus the US Dollar:

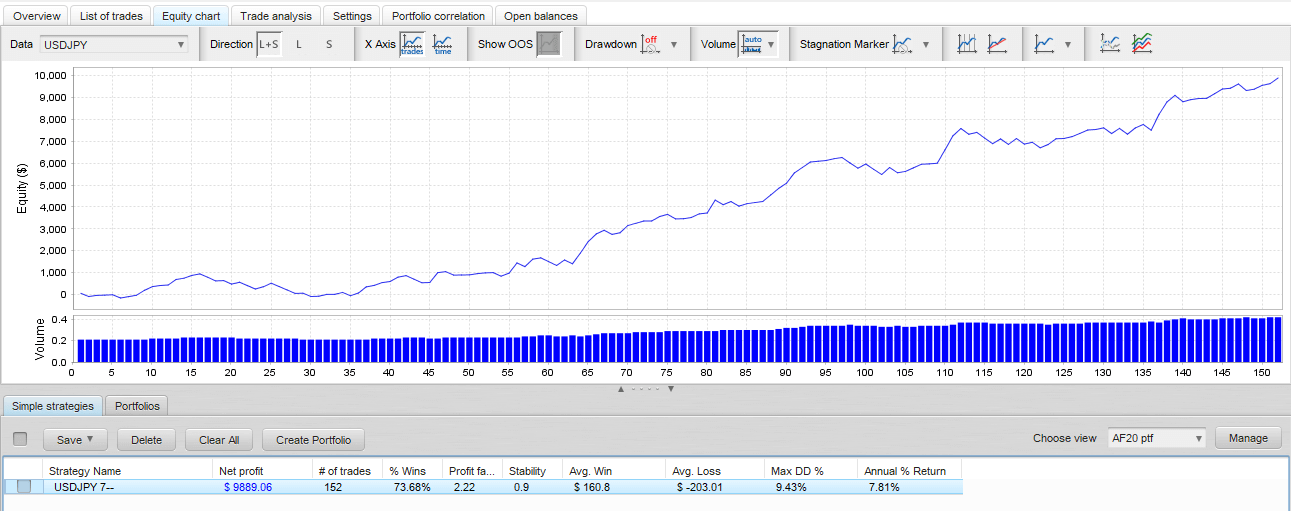

USDJPY: on the seventh day of the month, the Japanese Yen tends to gain versus the US Dollar:

In each BTM Expert Advisor page there is a link to download for free a demo portfolio containing these 4 expert advisors and others from different strategies. They can be used in backtest and live trading with limited contracts.

These 4 expert advisors are some pillars of the High Potential Days Selected Portfolio, which is a pillar of the Complete Selected Portfolio.

Live trading performances are very interesting and the statistics built over many decades gives great opportunities to these expert advisors to continue to earn in the future as well.

I didn’t think statistics would prove that Larry was right. Better so!