We use cookies to make your experience better. To comply with the new e-Privacy directive, we need to ask for your consent to set the cookies. Learn more.

Forex Correlation as a key to understand the market

Summary

- How to make the most by correlation between currencies and commodities

- Correlation between Gold (XAU) and US Dollar (USD)

- Correlation between US Dollas (USD) and Crude Oil (WTI)

- Strategy on Correlation between Currencies and Raw Materials

- Correlation between Currencies to diversify risk

- Correlation between Currencies and risk edging

- Conclusions

How to make the most by correlation between currencies and commodities

Correlation between currencies and commodities mean the relationship between the price trends of the same. The term "Correlation" describes the relationship between two variables, in this case currencies and commodities.

The correlation becomes important when one wants to invest in financial markets by considering more than one currency pair or raw materials, with the intent to consider the reciprocal reactions that are created between two or more elements taken into consideration.

Professional traders know very well that trading requires a perspective that goes beyond the forex world, as currencies, as well as commodities, are driven by numerous factors such as: supply and demand, politics, interest rates, economic growth and so on.

In particular, since economic growth and exports are directly linked to a country's national industry, it is natural that some currencies are strictly correlated with the prices of the main commodities exported or imported.

In this article we want to deepen the topic about Forex and Commodities correlation, especially the following:

- Correlation between Gold (XAU) and Australia Dollar (AUD)

- Correlation between US Dollar (USD) and Crude Oil (WTI)

The main correlations with raw materials and in particular with Gold and Oil can be found with the Australian Dollar (a major gold exporter) and the US Dollar. Another currency influenced by the price of Oil but with a lower correlation is the Japanese yen (big oil importer). Knowing which currency is related to which commodity can help you understand certain market changes even before they occur, increasing your chances of success.

Correlation between Gold (XAU) and US Dollar (USD)

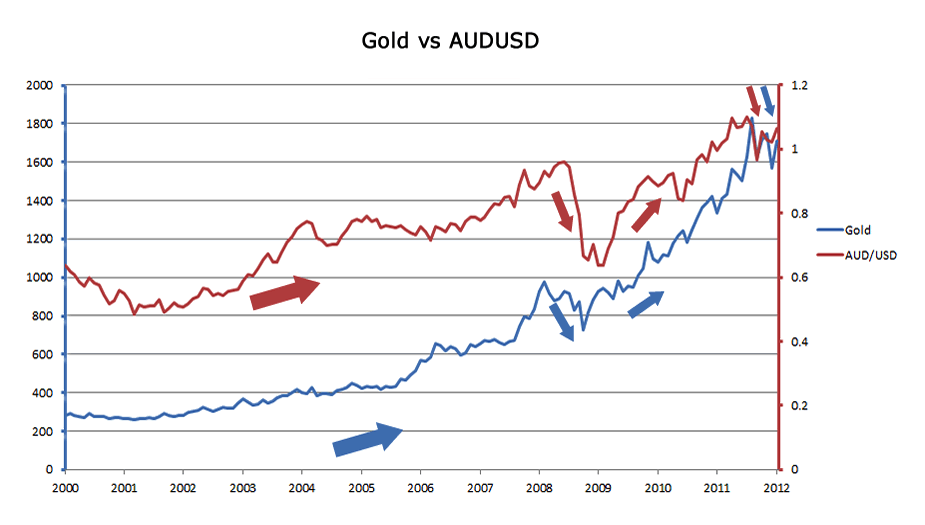

Australian Dollar (AUD) trading is very similar to Gold trading. Australia is the third largest producer of precious metals in the world, that’s why Australian Dollar and Gold have a very high level of correlation.

During periods of market uncertainty, due for example to economic or political problems, Gold (represented by the symbol XAU) plays the role of a safe haven and a hedge against inflation. Given that commodities such as Gold act as a kind of deposit of value intended to last beyond the uncertainty of the market in these difficult times, their price tends to rise.

Since Gold is commonly traded against the US dollar, these two components have an inverse relationship, that is, a higher Gold price typically results in a weaker Dollar and vice versa. This is why the Australian Dollar (AUD), which is also related to Gold, is up. Commonly referring to the AUD as a commodity currency (a currency closely linked to the trend of raw materials) due to its heavy dependence on the export of metals, such as gold.

Correlation between US Dollas (USD) and Crude Oil (WTI)

In the same way that Australian Dollar (AUD) prices are related to Gold and USD, even most commodities such as Oil are affected.

Oil is quoted in USD Dollars and this greatly affects the international oil trade:

if the value of the USD increases, with the same amount of money it is possible to purchase a greater quantity of Oil and its price drops;

if the value of the USD falls, on the other hand, it is necessary to pay a greater sum of dollars to buy the same amount of Oil, so the price goes up.

The correlation between USD and Oil certainly offers many food for thought and supports the technical and fundamental analysis in a relevant way. Price trends and some changes in the oil market are certainly able to influence the foreign exchange market, especially when analysing long-term trends. The link is also appreciable even in reduced time-frame and often conditions the market even in its intraday oscillations.

Strategy on Correlation between Currencies and Raw Materials

Starting from the fact that the correlation is simply to contrast the different assets and the differences that exist between the various elements, as well as to highlight the points in common, for example, the effects based on the same causes. In practice, it is a matter of understanding how currency pairs behave in the presence of certain conditions, such as those of the market that affect both the reference markets, how they respond to the currency that is part of the pair as well as others.

The best strategy to use on the correlations between currencies and raw materials, plans to operate with at least three crosses, of which two directly or inversely correlated (also considering the rollover rates) and a third to cover set on a transaction with positive rollover. These two are necessary elements for the study of currency pairs and in the planning of an investment based on the correlation between currencies in Forex.

Correlation between Currencies to diversify risk

Understanding which correlation of currencies exists also allows investing in multiple currency pairs while maintaining the same view on the market. Instead of investing in only one currency pair at a time, you can diversify the risk on two currency pairs moving in the same direction.

Take, for example, two highly correlated currency pairs such as EUR / USD and GBP / USD. Their imperfect correlation gives the opportunity to diversify, which helps to reduce the risk.

For example, let's say you're bullish on the US dollar. Instead of opening two short EUR / USD positions, it could go short on EUR / USD and short on GBP / USD; so the risk is diversified. Should the dollar fall unexpectedly, the euro could have risen less than the pound sterling.

Correlation between Currencies and risk edging

Although hedging transactions can generate lower profits, they can also minimise losses.

For example, if your long EUR / USD position starts to record losses, you open a small long position on a pair that moves in the opposite direction of EUR / USD, such as USD / CHF.

Although it looks like a perfect solution, in reality the cover positions have disadvantages. If the EUR / USD rises, your profits are limited due to losses recorded on your USD / CHF position.

Furthermore, the correlation between two currency pairs can vary at any time.

Conclusions

Markets are characterised by correlations of prices, given by the nature of the instrument traded and its economic background. It is important to know the historical correlation between Currencies and Commodities, in order to know at least the basic rules to set an edged trading system. Theory before coding. Good models are the only way to create a good trading systems able to last in time.